Table of Contents:

Table of Contents:

- Introduction: Embracing Financial Empowerment through My Money Budget

- Understanding the Importance of Budgeting and Money Management

- Getting Started: Creating Your Personalized My Money Budget

- Exploring Online Free Budgeting Tools for Enhanced Financial Planning

- Navigating Key Expenses: Making a Budget Spreadsheet for Effective Management

- Prioritizing Financial Goals: Incorporating Savings for Retirement Now

- Harnessing the Power of Cash Saving Techniques in Your Budget

- Leveraging Free Bill Spreadsheets for Efficient Expense Tracking

- Achieving Early Retirement: Strategies for Budgeting and Investment

- Conclusion: Empower Your Financial Journey with My Money Budget

Introduction: Embracing Financial Empowerment through My Money Budget

In today's dynamic financial landscape, mastering the art of budgeting is crucial for achieving long-term prosperity and security. One of the most effective tools in this endeavor is creating a personalized budget tailored to your individual needs and goals. In this article, we will explore the concept of "My Money Budget" and how it can serve as your guiding compass on the path to financial success. Through practical tips, insightful strategies, and innovative tools, we'll navigate the journey together, empowering you to take control of your finances with confidence.

Understanding the Importance of Budgeting and Money Management

Before delving into the specifics of My Money Budget, it's essential to understand why budgeting and money management are fundamental aspects of financial well-being. Budgeting allows individuals to track their income and expenses, gain insight into their spending habits, and identify areas where adjustments can be made to achieve financial goals. Moreover, effective money management ensures that resources are allocated wisely, enabling individuals to save for the future, invest in growth opportunities, and navigate financial challenges with resilience.

Getting Started: Creating Your Personalized My Money Budget

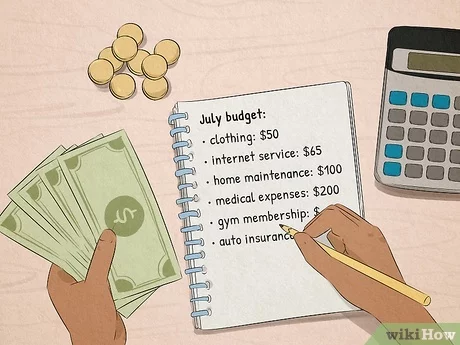

Creating a personalized my money budget begins with a comprehensive assessment of your financial situation. Start by listing all sources of income, including salaries, bonuses, and passive income streams. Next, itemize your monthly expenses, categorizing them into essential and discretionary categories. Essential expenses may include housing, utilities, groceries, and transportation, while discretionary expenses encompass entertainment, dining out, and luxury items.

Once you have a clear overview of your income and expenses, it's time to set financial goals and allocate funds accordingly. Whether your objectives include saving for retirement now, building an emergency fund, or paying off debt, your budget should reflect these priorities. Additionally, consider incorporating a buffer for unexpected expenses or fluctuations in income, ensuring flexibility and adaptability in your financial plan.

Exploring Online Free Budgeting Tools for Enhanced Financial Planning

In today's digital age, technology offers a plethora of resources to streamline the budgeting process and enhance financial planning. Online free budgeting tools provide users with intuitive platforms to track income, categorize expenses, and visualize financial trends. From mobile apps to web-based software, these tools offer convenience, accessibility, and real-time insights into your financial health.

Navigating Key Expenses: Making a Budget Spreadsheet for Effective Management

A budget spreadsheet serves as a foundational tool for effective expense management and financial organization. Whether you prefer a simple Excel sheet or a more advanced software program, creating my money budget spreadsheet allows you to customize categories, track transactions, and monitor progress towards your financial goals. By regularly updating your spreadsheet and reviewing your spending patterns, you can identify areas for improvement, make informed decisions, and stay on track with your budgeting objectives.

Prioritizing Financial Goals: Incorporating Savings for Retirement Now

While budgeting addresses immediate financial needs and obligations, it's equally important to plan for the future, particularly when it comes to retirement. Saving for retirement now ensures that you have sufficient funds to support your lifestyle and achieve your desired level of financial independence in later years. Whether through employer-sponsored retirement plans, individual retirement accounts (IRAs), or other investment vehicles, allocating a portion of your income towards retirement savings is a proactive step towards securing your financial future.

Harnessing the Power of Cash Saving Techniques in Your Budget

In addition to traditional savings accounts and retirement plans, incorporating cash-saving techniques into your my money budget can yield significant long-term benefits. From cutting unnecessary expenses to negotiating lower bills and leveraging discounts and rewards programs, there are various strategies to stretch your dollars further and maximize your savings potential. By adopting a frugal mindset and embracing mindful spending habits, you can build a stronger financial foundation and accelerate your journey towards financial freedom.

Leveraging Free Bill Spreadsheets for Efficient Expense Tracking

Managing monthly bills and expenses can be a daunting task, especially with numerous payments and due dates to keep track of. Fortunately, free bill spreadsheets offer a simple yet effective solution for organizing and managing your financial obligations. These customizable templates allow you to input bill details, set reminders for upcoming payments, and track payment history, ensuring that you stay on top of your financial commitments and avoid late fees or penalties.

Achieving Early Retirement: Strategies for Budgeting and Investment

For those aspiring to retire early and enjoy financial independence at a younger age, strategic money budgeting and investment are essential components of the plan. By prioritizing savings, minimizing expenses, and investing prudently, individuals can accumulate wealth more rapidly and achieve their retirement goals ahead of schedule. Whether through traditional investment vehicles such as stocks and bonds or alternative strategies like real estate or entrepreneurship, early retirement is within reach for those willing to prioritize financial discipline and long-term planning.

Conclusion: Empower Your Financial Journey with My Money Budget

Mastering the art of budgeting and money management is a transformative journey that empowers individuals to take control of their financial destinies and unlock a future of prosperity and abundance. By embracing the concept of My Money Budget and incorporating practical strategies into your financial plan, you can navigate life's financial complexities with confidence and clarity. Whether it's saving for retirement now, managing monthly expenses, or pursuing early retirement dreams, the path to financial success begins with a commitment to mindful budgeting and informed decision-making. As you embark on this journey, remember that financial freedom is not merely a destination but a way of life—an opportunity to live on your own terms and create the life you've always envisioned.

Recommended Article: Canapé COVID-Suitable !

Comments