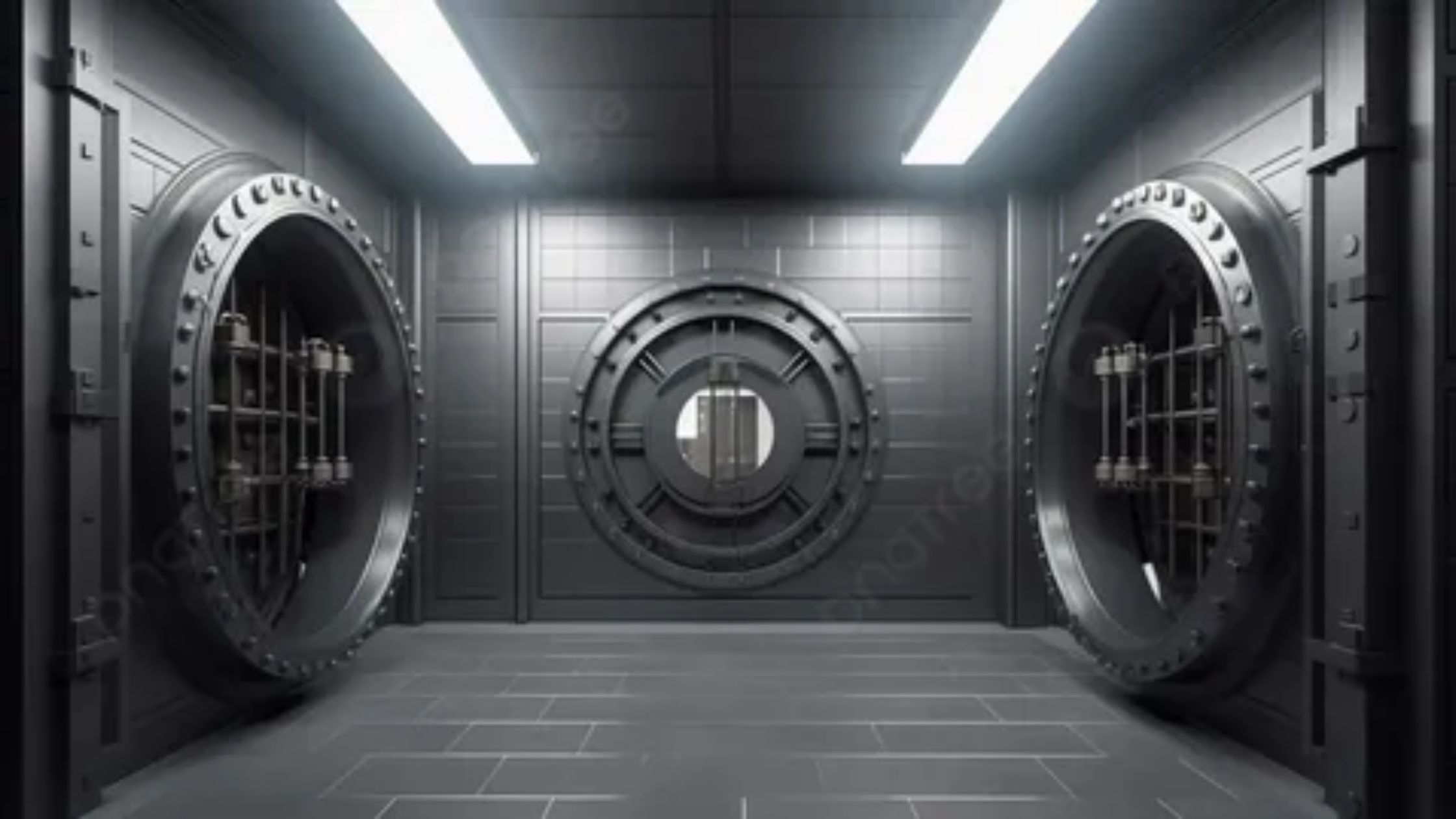

Vault cash isn’t just money sitting in the back. It’s part of your bank’s lifeline. Cash in the vault keeps your ATMs full. It helps with customer withdrawals. It keeps things running. But there’s more to it. Banks in Colorado must think carefully about how they handle this cash. That’s where Vault Cash Management Colorado becomes important.

What Is Vault Cash?

Vault cash is the physical money held inside your bank. That includes bills in teller drawers and in the vault. It also includes ATM cash. This cash is counted as part of your reserves with the Federal Reserve. So yes, it does more than just sit there.

Holding too much vault cash? You’re losing value. That cash could be working somewhere else. Holding too little? You risk not meeting customer needs. So, the balance matters.

It Affects More Than You Think

Vault cash plays into your reserve balance. If you have more vault cash, you need less at the Fed. But keeping too much hurts your earning potential. That money isn’t making interest. It’s just sitting there.

Every dollar in the vault should have a reason. That’s why smart planning is key. You need to know your peak cash times. Payday? End of the month? Holidays? Data can help you stay ready. Not guessing. Planning.

Risks of Poor Vault Cash Management

Bad planning can cost you. If you're short, you scramble to get more. That means extra costs, delays, and maybe unhappy customers. If you hold too much, it adds risk. Theft, loss, even miscounts.

Also, cash stored wrong can lead to mix-ups. That can snowball into big losses. You need trained staff. Clear checks. Regular audits.

The Role of a Vault Cash Management Company

Many Colorado banks now work with a Vault Cash Management Company Colorado. These companies handle cash forecasting, storage, and transport. They work behind the scenes. But they play a big part.

They help reduce cash idle time. They schedule pickups and drop-offs. They support emergency cash needs. More banks are choosing this route because it saves time. And it saves money.

Outsourcing vault cash lets your team focus on the customer. Not cash logistics.

Technology Is Helping Too

Smart software now tracks cash usage. It can tell you how much you need — and when. The software looks at past withdrawals. It watches cash-in and cash-out trends. Some tools can even predict holiday rushes.

When tech and service work together, your cash flow stays tight. No waste. No shortages.

Train Staff the Right Way

No matter how good your systems are, your staff still counts. Train them to spot patterns. Teach them how to flag cash issues. They should know who to call in a shortage. Or what to do if a shipment is late.

Your people are your first defense against vault errors.

Keep Records Tight

Every deposit, withdrawal, and movement should be recorded. Make sure cash counts match reports. Reconcile daily. If you spot mistakes fast, you can fix them before they grow.

Also, don't ignore small differences. Today’s $10 mistake might turn into a $1,000 issue next week.

Think Long-Term

Vault cash is part of your cost of doing business. But that doesn’t mean it should go unchecked. Long-term planning reduces risk. It helps you move faster when customer demands shift. Or when new branches open.

Use past data to forecast future needs. Review trends every quarter. Adjust, adapt, and aim to get better each time.

Conclusion

Every bank in Colorado should treat vault cash as a moving part of daily operations. It’s not just about what’s on hand — it’s about how that cash supports your goals. A strong Vault Cash Management Colorado plan can reduce costs, improve security, and support better banking.

For banks looking to make vault handling smarter, a Vault Cash Management Company Colorado can be the key. With expert help, you get more control and fewer surprises.

Sectran Security helps banks across Colorado stay in control of their cash. They offer fully insured armored transport with strict cash-handling protocols. With top safety measures and smart routing, they help make vault cash management simple and safe.

Comments